The Fair Finance Institute provides consultation services for decision-makers at all levels, ministries and authorities as well as NGOs and other stakeholders in the financial and monetary systems on strategy and policy development for the ‘financial turnaround’.

Everything important at a glance

BASIC APPROACH

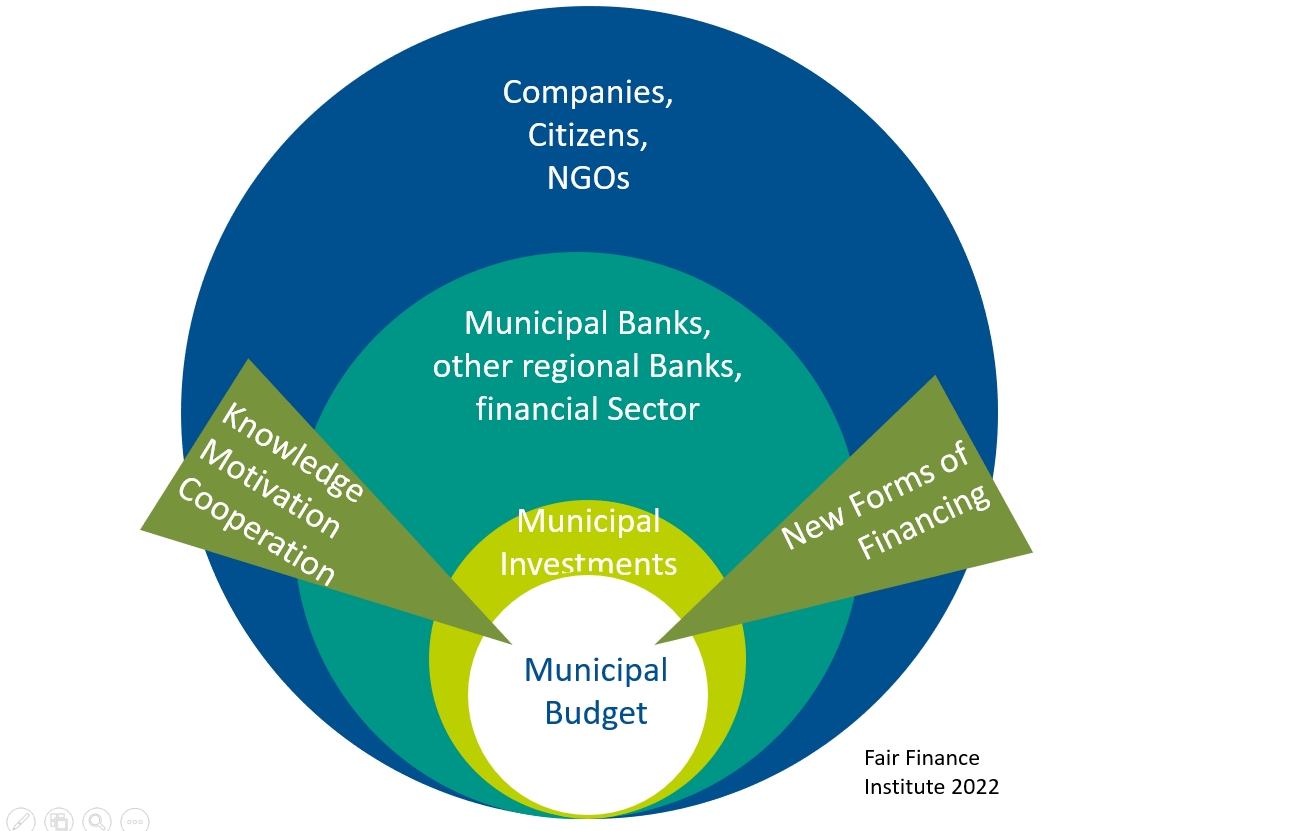

These services provided by the FaFin take into account the aspects of the phase models of major social changes formulated under “Basic idea“. In addition to the municipal concepts already listed there as examples, there are many other approaches: Municipal agencies, the establishment of sustainability standards and labels, the development of responsibilities and institutions for sustainability in the financial sector and many other building blocks can in principle also be designed for the financial sector, which played a central role in the energy system transformation.

FaFin transfers these building blocks from principle to the topic area of the financial system. However, it adapts these ideas in a very concrete, pragmatic and practical way together with stakeholders and affected actors. In view of the wide range of possible topics, external experts from the FaFin network, among others, are consulted where necessary to specify the details.

EXAMPLE "LOCAL SUSTAINABLE FINANCE ACTION PLANS"

The Fair Finance Institute participatively develops so-called “Local Sustainable Finance Action Plans”: This service involves a combination of networking of local, interested initiatives and institutions, training, public relations and political initiatives. Finally, a concrete action guideline with strategically coordinated measures for the next 3 to 5 years is created as a strategic concept: “Our Way to a Sustainable Finance Municipality”.

As part of the pilot project “turnaround money“, for example, proposals for such action plans were developed for the cities of Mannheim and Munich.

Such concepts are also conceivable for other political levels such as counties or federal states.

Furthermore Markus Duscha has already supported many municipalities and federal states in the development of climate related strategy plans, including Aschaffenburg, Frankfurt am Main, Cologne, Mörfelden-Walldorf, Münster/Westf., Seckach/Odenwald, Weil am Rhein as well as the federal states of Lower Saxony and Saxony.

EXAMPLE NGO-MONITOR SUSTAINABILITY

In 2018, the Fair Finance Institute, together with Landesbank Baden-Württemberg (LBBW, Federal State Bank of Baden-Wuerttemberg), developed an overview tool based on published information: What do non-governmental organisations (“NGOs”) demand from banks in general and from individual banks in particular with regard to sustainability? For example, over 40 studies from around 60 NGOs were evaluated for the year 2017.

The tool can be updated and can therefore also reflect developments over time. In principle, the evaluations can be carried out for all banks / financial service providers. Each bank receives its specific results in addition to the general bank-unspecific results.

The tool “LBBW NGO Monitor Sustainability” was presented by FaFin together with LBBW at the UNEP FI / VfU Roundtable on 12.9.2018 in Munich in a workshop.

Example: Importance of the topics and which NGO mentions on which topic your bank? (sample presentation)